UA

7 Min Read

1. AI-Powered Fraud Detection Systems

AI can analyze vast amounts of transactional and behavioral data in real-time, enabling businesses to detect potential fraudulent activities as they happen. Machine learning (ML) models, a subset of AI, can be trained on historical data to identify patterns and anomalies that may indicate fraud. These systems continuously learn from new data, improving their accuracy over time.

Anomaly Detection: AI can automatically flag unusual transactions or behaviors, such as large transactions outside of normal business hours or from unfamiliar locations, which are common indicators of fraud.

Pattern Recognition: AI systems can analyze historical data to identify recurring fraudulent behavior, making it easier to detect fraudulent actions before they escalate.

2. Predictive Analytics for Fraud Prevention

AI uses predictive analytics to forecast potential fraud before it happens by analyzing patterns, trends, and risk factors. This approach helps businesses take preventive measures rather than just reacting after fraud has occurred.

Risk Scoring: AI can assign risk scores to transactions based on historical fraud patterns, client behavior, and transaction history. Transactions with high-risk scores can be flagged for further investigation.

Behavioral Analytics: AI systems can assess user behavior, such as login times, browsing patterns, and purchase histories, to detect deviations that might indicate fraudulent activity.

3. Natural Language Processing (NLP) for Fraud Detection

AI's NLP capabilities can be used to monitor and analyze communications, both internal and external, to detect signs of fraudulent intent. This includes emails, chats, and social media interactions.

Email and Text Analysis: AI can automatically scan emails for phishing attempts, suspicious links, or fraudulent content, reducing the chances of business email compromise (BEC).

Social Media Monitoring: AI can analyze social media conversations for signs of fraud, such as fake reviews, impersonation attempts, or identity theft.

4. Machine Learning for Real-Time Fraud Detection

Machine learning models are trained to recognize fraud patterns by learning from vast datasets, including both historical fraud cases and legitimate transactions. Over time, these models improve their ability to differentiate between normal activities and potential fraud, allowing businesses to respond in real time.

Adaptive Learning: ML models can adapt to new fraud strategies as fraudsters evolve their techniques. This flexibility makes AI a more effective tool than traditional rule-based fraud detection methods.

Real-Time Alerts: Machine learning algorithms can immediately trigger alerts when suspicious activities are detected, allowing businesses to respond to fraud attempts in real time.

5. AI-Driven Identity Verification

AI is helping businesses prevent identity theft and account takeover by implementing advanced identity verification techniques. These systems use biometrics, face recognition, and voice recognition to verify the identity of users or customers.

Biometric Authentication: AI-powered facial recognition and fingerprint scanning can be used to confirm the identity of users when they log into accounts, making it harder for fraudsters to impersonate legitimate users.

Voice Recognition: AI systems can analyze voice patterns to confirm identities during phone-based transactions or customer service interactions, preventing fraudulent activity during phone scams or account takeovers.

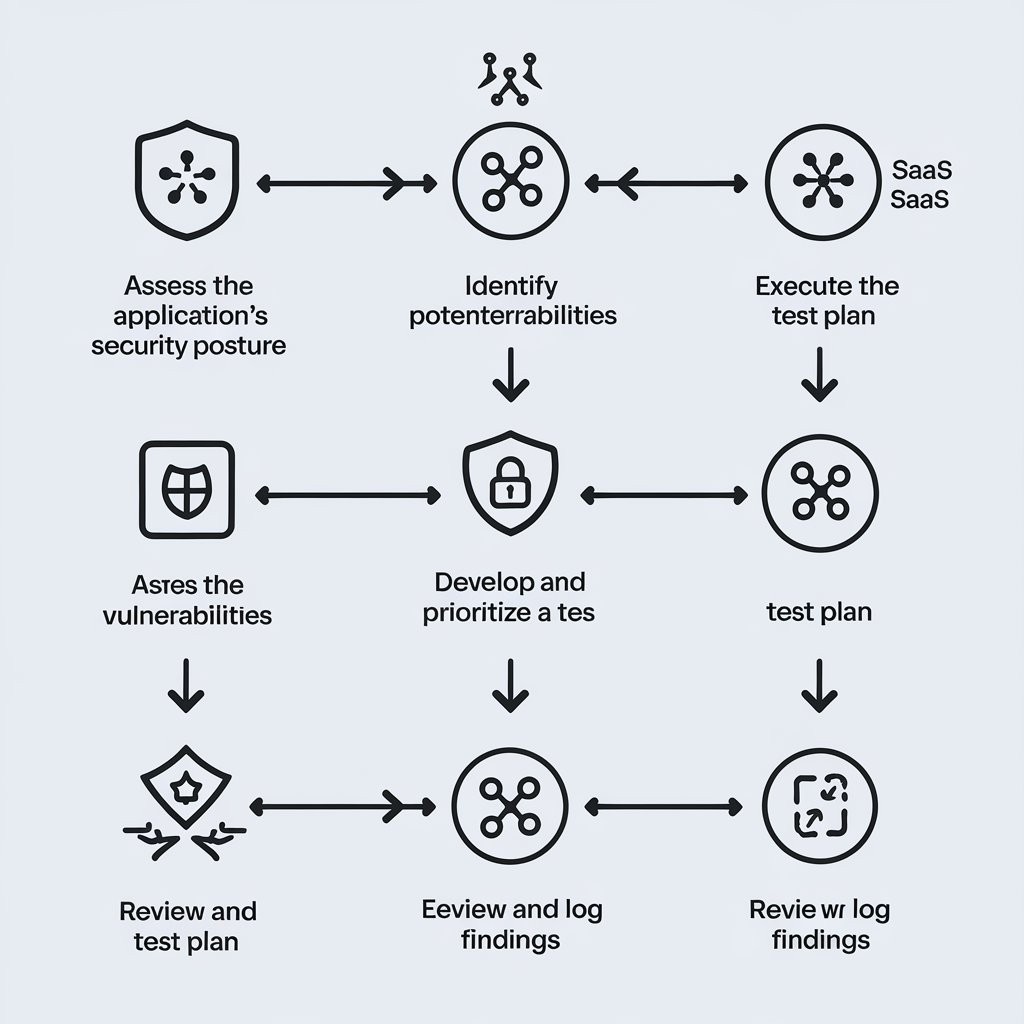

6. Automation of Fraud Investigation

AI can also automate the fraud investigation process, making it faster and more accurate. By automating repetitive tasks, AI can free up investigators to focus on high-risk cases.

Automated Case Creation: When fraud is detected, AI systems can automatically generate a case, gather evidence, and even suggest possible causes, reducing the need for manual intervention.

Streamlining Workflow: AI tools can help investigators by automatically sorting and prioritizing cases based on risk level, enabling them to focus on the most critical incidents first.

7. AI in Fraudulent Claims Detection

AI can play a crucial role in the detection of fraudulent claims, particularly in industries like insurance, healthcare, and finance. By analyzing historical claim data, AI systems can identify suspicious claims patterns and flag them for review.

Claim Verification: AI systems can cross-check the legitimacy of claims by validating them against customer histories, transaction records, and external databases, identifying potential fraud attempts.

Fraudulent Document Detection: AI can scan documents submitted for claims to detect alterations, such as forged signatures or falsified data, through image recognition and text comparison.

8. Enhanced Customer Authentication

AI can help businesses implement stronger and more secure authentication measures to protect against fraud. Multi-factor authentication (MFA) is one of the most effective methods for ensuring that only authorized users can access sensitive business systems or make transactions.

Behavioral Biometrics: AI can track and analyze user behavior, such as typing speed, mouse movements, and screen touches, to create a unique behavioral profile. If a fraudster tries to access an account, the AI system can recognize the discrepancy and trigger a fraud alert.

Real-Time Fraud Blocking: AI can help block fraudulent transactions in real time by analyzing user behavior and transaction data for signs of fraud, ensuring that businesses are protected before damage occurs.

9. Fraud Prevention in E-commerce

In e-commerce, AI technologies can identify fraudulent transactions, payment fraud, and account takeovers by monitoring transactions and customer activity on websites or mobile apps.

Transaction Monitoring: AI can analyze the context of online transactions, flagging purchases that deviate from normal patterns, such as high-value items being purchased with stolen credit cards.

Bot Detection: AI can identify automated bots used in fraud attempts, such as account creation bots or bots designed to scrape credit card information, and prevent them from accessing systems.

10. Predicting Fraudulent Behavior Using Data Mining

AI systems use data mining techniques to analyze vast amounts of historical and real-time data to predict fraud. By examining historical fraud patterns, AI can make more accurate predictions and help businesses prevent future incidents.

Data Correlation: AI can correlate seemingly unrelated data points—such as transaction types, customer profiles, and geographic locations—to identify emerging fraud risks.

Early Detection: By mining data from various sources, AI can detect fraudulent trends early, enabling businesses to take preventive action before fraud escalates. audit3aa

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

You can copy our materials only after making sure that your services are safe.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.