UA

10 Min Read

What is a Fraud Risk Assessment?

A fraud risk assessment is a systematic process used by organizations to identify, evaluate, and prioritize potential fraud risks. It involves assessing the vulnerabilities within business processes, operations, and systems where fraud might occur, determining the likelihood and potential impact of each risk, and implementing controls to mitigate those risks. Regular fraud risk assessments are essential for proactive fraud prevention and protecting organizational assets.

Why is Fraud Risk Assessment Important in 2024?

Fraud risk assessments are more vital in 2024 due to the following factors:

Increasing Cyber Threats: The rise of digitalization and cloud-based solutions has increased exposure to cyber fraud, such as data breaches and financial fraud.

Evolving Fraud Tactics: Fraud schemes, like social engineering and identity theft, are becoming more sophisticated, necessitating a robust risk management strategy.

Regulatory Compliance: Organizations must comply with growing regulations around financial transparency, cybersecurity, and fraud detection, such as GDPR, HIPAA, and PCI DSS.

Reputation and Trust: A failure to address fraud risks can damage an organization’s reputation, customer trust, and long-term success.

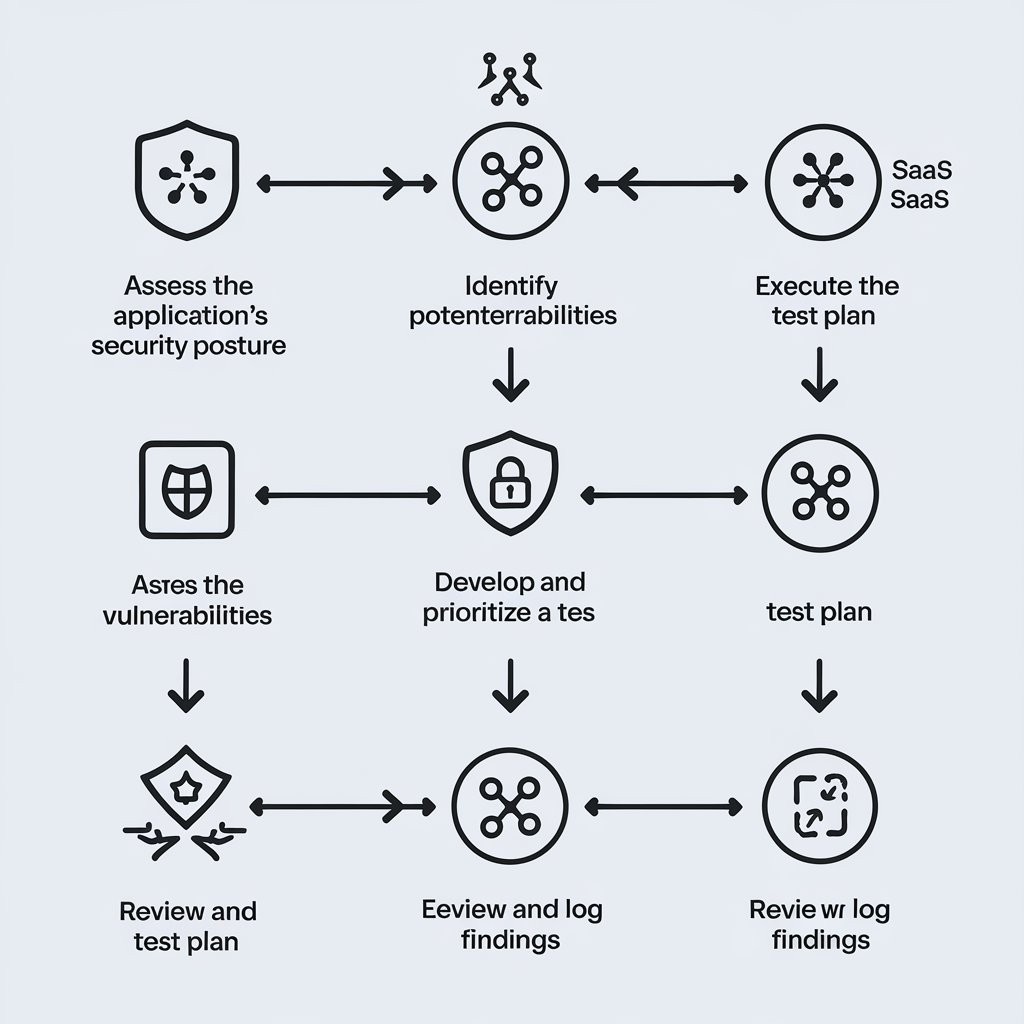

Steps to Perform a Fraud Risk Assessment in 2024

Performing a fraud risk assessment involves multiple steps that work together to identify and mitigate fraud risks. Here’s how you can get started:

1. Identify and Understand Business Processes

Start by gaining a comprehensive understanding of your organization’s key business processes. Every business has different operational models, which means fraud risks may vary across departments. Common areas to review include:

Financial reporting: The likelihood of fraudulent financial reporting, such as falsifying financial statements.

Procurement and supplier management: Risks related to bribery, kickbacks, or over-invoicing.

Employee fraud: Issues like embezzlement, misuse of company funds, or insider trading.

IT systems and cybersecurity: Risks from unauthorized access, data breaches, and identity theft.

Review these areas across your organization, paying special attention to processes that involve financial transactions, sensitive data handling, or employee behavior.

2. Assess the Risk Impact and Likelihood

Once you’ve identified potential fraud risks, assess their potential impact and the likelihood of occurrence. This step helps prioritize the risks, ensuring that resources are allocated effectively.

Risk Likelihood: Evaluate how likely it is that each identified fraud risk will occur. Use historical data, industry reports, and expert opinions to determine the probability.

Impact Assessment: Consider the potential financial, operational, and reputational damage each fraud risk could cause. High-impact risks should receive more attention during the mitigation phase.

For example, an internal employee committing financial fraud could have a high likelihood but a relatively lower impact compared to a data breach that compromises customer information, which could severely damage the company’s reputation.

3. Develop and Implement Fraud Prevention Controls

Once you’ve identified and assessed the risks, it’s time to implement controls and strategies to reduce or eliminate those risks. These controls may include:

Segregation of Duties: Divide key responsibilities among different employees to prevent any single person from having too much control over financial transactions.

Internal Audits: Regular audits can detect anomalies in financial transactions, inventory management, and other processes.

Access Control Systems: Restrict access to sensitive data and systems to authorized personnel only.

Fraud Detection Software: Invest in fraud detection systems and AI-powered tools that monitor transactions in real-time for signs of fraud.

Employee Training: Educate employees on fraud risks, ethical conduct, and how to spot suspicious activity.

By implementing these controls, businesses can significantly reduce the risk of fraud or at least detect it early in the process.

4. Monitor and Track Fraud Risks Continuously

Fraud risk management is not a one-time process; it requires continuous monitoring and adjustment. New fraud risks will emerge as your business evolves and technology advances, so regular monitoring is essential.

Real-Time Fraud Detection: Use advanced analytics, AI tools, and machine learning algorithms to identify unusual patterns or suspicious behavior that might indicate fraud.

Review Fraud Cases: Continuously monitor your organization’s financial transactions and operational processes. Look for unusual spikes, inconsistencies, or anomalies that warrant further investigation.

Regular Audits: Schedule frequent internal and external audits to detect potential fraud.

It’s important to have a mechanism for reporting and tracking incidents of fraud. Any detected fraud should be thoroughly investigated and handled in accordance with your organization’s policies.

5. Ensure Compliance with Regulations and Industry Standards

Fraud risk assessments are closely linked to regulatory compliance. In 2024, businesses must comply with a range of industry regulations that require the identification and mitigation of fraud risks, including:

General Data Protection Regulation (GDPR): Ensures the privacy and protection of customer data, requiring businesses to manage fraud risks associated with data breaches.

Sarbanes-Oxley Act (SOX): Requires companies to implement internal controls to prevent fraudulent financial reporting.

PCI DSS: Provides a set of security standards to protect payment card information.

Ensure your fraud risk assessment aligns with these and other relevant regulations to avoid penalties and ensure business continuity.

6. Develop an Incident Response Plan

An effective fraud risk assessment should also include an incident response plan. In the event of a fraud occurrence, having a predefined process for managing and responding to the issue can significantly mitigate damage.

Your incident response plan should include:

Immediate actions: How to contain and prevent further fraud once detected.

Investigation process: How to investigate the incident and identify the fraud source.

Communication strategy: How to inform key stakeholders, such as regulators, customers, and partners, in case of a major fraud incident.

Post-incident review: Evaluating the effectiveness of the response and adjusting fraud risk management practices accordingly.

Leveraging Technology in Fraud Risk Assessment

In 2024, technology plays a significant role in enhancing the effectiveness of fraud risk assessments. Key technologies to incorporate include:

Artificial Intelligence and Machine Learning: These technologies can detect patterns and anomalies that are difficult for humans to spot. AI-powered tools can automatically flag suspicious activities in real-time.

Blockchain: For industries like finance, blockchain can enhance transparency and traceability, making it harder for fraudulent activities to go unnoticed.

Data Analytics: Leverage data analytics platforms to analyze large volumes of data and identify trends that may indicate fraud.

Conclusion

Performing a fraud risk assessment in 2024 is critical for businesses looking to protect their financial assets, ensure regulatory compliance, and maintain trust with customers. By systematically identifying, assessing, and mitigating fraud risks, businesses can safeguard themselves against the increasing threat of fraud. Regular monitoring and the use of advanced technologies will help organizations stay ahead of fraudsters and ensure long-term business resilience. audit3aa

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

You can copy our materials only after making sure that your services are safe.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.