UA

10 Min Read

Step 1: Define the Scope of the Fraud Risk Assessment

Before diving into the details of the fraud risk assessment, it's important to define the scope of the review. Identify the areas of your retail operation where fraud may occur. These areas could include:

Point of Sale (POS) Systems: In-store transactions are a prime target for fraud, whether through stolen credit card information or employee theft.

Online Retail: E-commerce fraud, including account takeovers, payment fraud, and fake returns, is becoming increasingly prevalent.

Employee Fraud: Internal fraud, such as theft, cash register manipulation, or collusion with customers, can occur at any stage of the retail process.

Supply Chain and Inventory: Fraud can also happen during inventory management and shipping, such as product misplacement, counterfeit goods, or supplier fraud.

Clarifying the areas to assess ensures that your analysis will be focused and comprehensive.

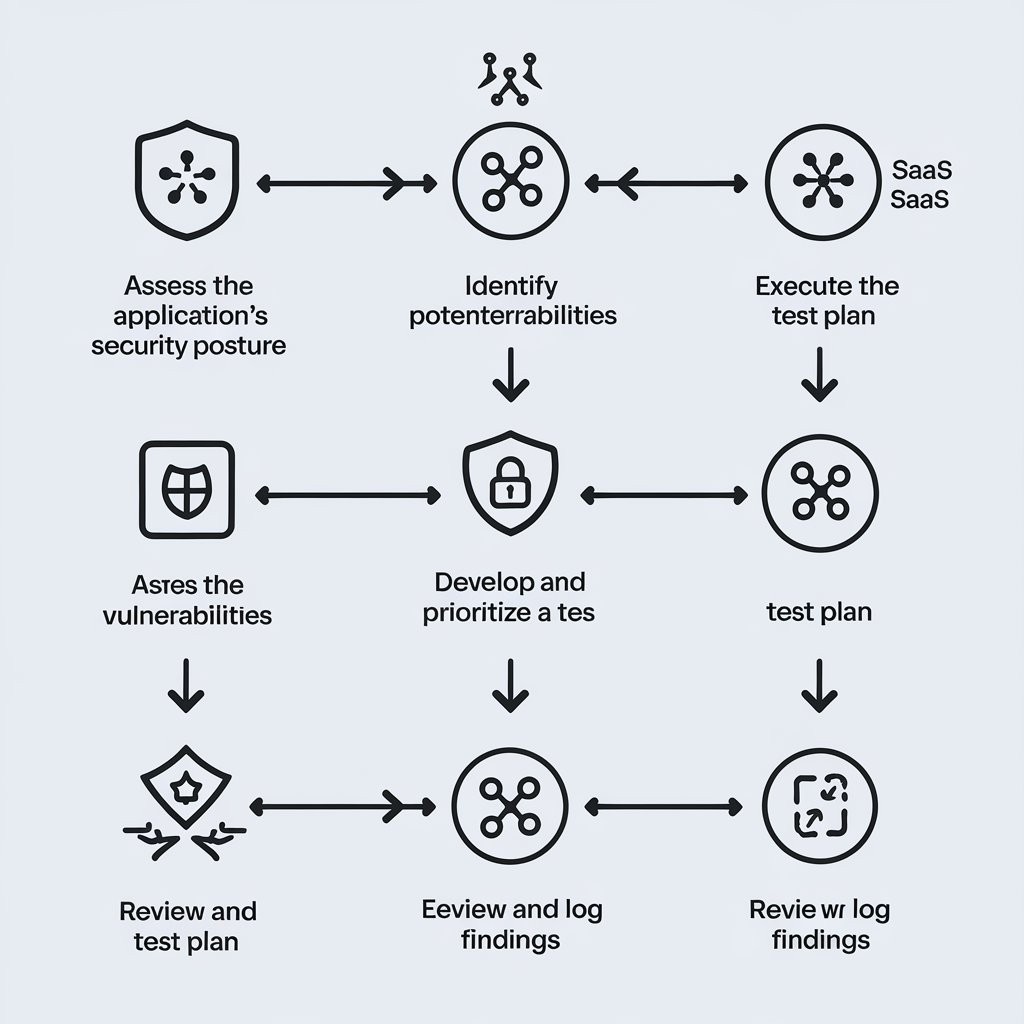

Step 2: Identify Potential Fraud Risks

After defining the scope, the next step is identifying potential fraud risks. This involves gathering data and analyzing the various risks faced by each area of the retail business.

Transaction Fraud: Review historical data to identify patterns of fraudulent activity, such as unauthorized returns, stolen credit card information, or fake discounts.

Employee Risk: Assess employee access to sensitive systems and processes. High-risk employees include those with access to inventory, POS systems, cash handling, and customer data.

Online Fraud: With the rise of e-commerce, online fraud risks like payment fraud, fake orders, and account takeovers have increased. Consider reviewing fraudulent transaction patterns and common online scams.

Supply Chain Fraud: Investigate potential risks in inventory management, including overcharging, counterfeit goods, or deliberate misreporting of inventory levels.

You should also gather feedback from key stakeholders in each department—sales, security, IT, and finance—to ensure you capture a broad range of perspectives on potential fraud risks.

Step 3: Evaluate the Likelihood and Impact of Each Risk

Once you have identified potential fraud risks, evaluate the likelihood and potential impact of each risk. This can be done using a risk matrix, which will help prioritize the risks based on their severity and probability.

Likelihood: Assess how likely it is that a particular fraud risk will occur. This can be determined by reviewing historical data, industry trends, or insights from stakeholders.

Impact: Consider the consequences of each fraud risk if it were to occur. This includes financial losses, reputational damage, customer trust erosion, and regulatory consequences.

For example:

Transaction fraud (high likelihood, high impact): Fraudulent transactions at the POS system could lead to significant financial loss.

Employee theft (moderate likelihood, high impact): Employees manipulating cash registers could result in large losses and reputational harm.

By ranking each risk according to its likelihood and impact, you can focus on the highest-priority threats.

Step 4: Implement Fraud Prevention Controls

Based on the fraud risks identified and assessed, the next step is to implement prevention controls to reduce the likelihood of fraud occurring.

POS System Controls: Implement robust security features like end-to-end encryption, tokenization, and secure payment gateways to protect against payment fraud. Consider using fraud detection systems that can monitor unusual transactions in real time.

Employee Screening: Implement thorough background checks for employees, particularly those in sensitive positions, such as cashiers, managers, or warehouse staff. Regularly review employee access to sensitive information and systems to prevent internal fraud.

Inventory Management: Introduce measures to track inventory in real-time and monitor for discrepancies. Use RFID tags, barcode scanning, and automated stock management systems to reduce opportunities for theft and fraud.

Online Fraud Prevention: Use multi-factor authentication (MFA) and advanced fraud detection tools for e-commerce sites. Implement CAPTCHA, IP tracking, and transaction monitoring to detect fraudulent activity. For chargebacks and fraudulent orders, verify customer information before processing returns or refunds.

Step 5: Develop a Response Plan for Fraud Incidents

Even with the best preventive measures, fraud may still occur. That’s why it’s essential to have a response plan in place. This plan should outline how to handle fraud incidents if they occur, including:

Incident Identification: Develop a system for quickly identifying and reporting fraud. This can include regular audits, transaction monitoring, and employee reporting mechanisms.

Investigation: Create a protocol for investigating suspected fraud, such as reviewing transaction records, interviewing involved parties, and collaborating with law enforcement if necessary.

Customer Communication: In the event of customer-facing fraud, ensure there is a clear communication plan in place to inform customers, offer compensation, and maintain transparency.

Legal and Regulatory Compliance: Ensure that the response plan complies with relevant data protection regulations (e.g., GDPR, CCPA) and fraud-related laws. Keep detailed records of the investigation for compliance and legal purposes.

Step 6: Monitor and Update Fraud Risk Assessment Regularly

Fraud risks evolve over time, as do the methods used by fraudsters. It’s essential to continuously monitor fraud risks and update your assessment regularly.

Continuous Monitoring: Set up automated monitoring systems to track transaction data, inventory, and employee activities. Real-time monitoring can help detect fraud early and reduce the overall impact.

Regular Audits: Conduct periodic audits of your fraud prevention measures, including reviewing employee access controls, system security, and fraud detection tools.

Training: Provide regular fraud prevention training for employees, ensuring they are aware of the latest fraud trends and understand how to recognize and report suspicious activity. audit3aa

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

You can copy our materials only after making sure that your services are safe.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.