UA

10 Min Read

Types of E-commerce Fraud

Payment Fraud

Use of stolen credit card information for unauthorized purchases.

Chargeback fraud, where customers claim refunds for false disputes.

Account Takeover

Cybercriminals gain access to customer accounts using stolen credentials.

Exploitation of accounts to make unauthorized purchases or steal information.

Identity Theft

Creation of fake accounts using stolen personal information.

Use of fake identities for fraudulent transactions.

Phishing Scams

Deceptive emails or messages designed to steal sensitive information.

Promo Abuse

Exploitation of discounts, coupons, or referral programs for financial gain.

Friendly Fraud

Legitimate customers falsely claim that a transaction was unauthorized.

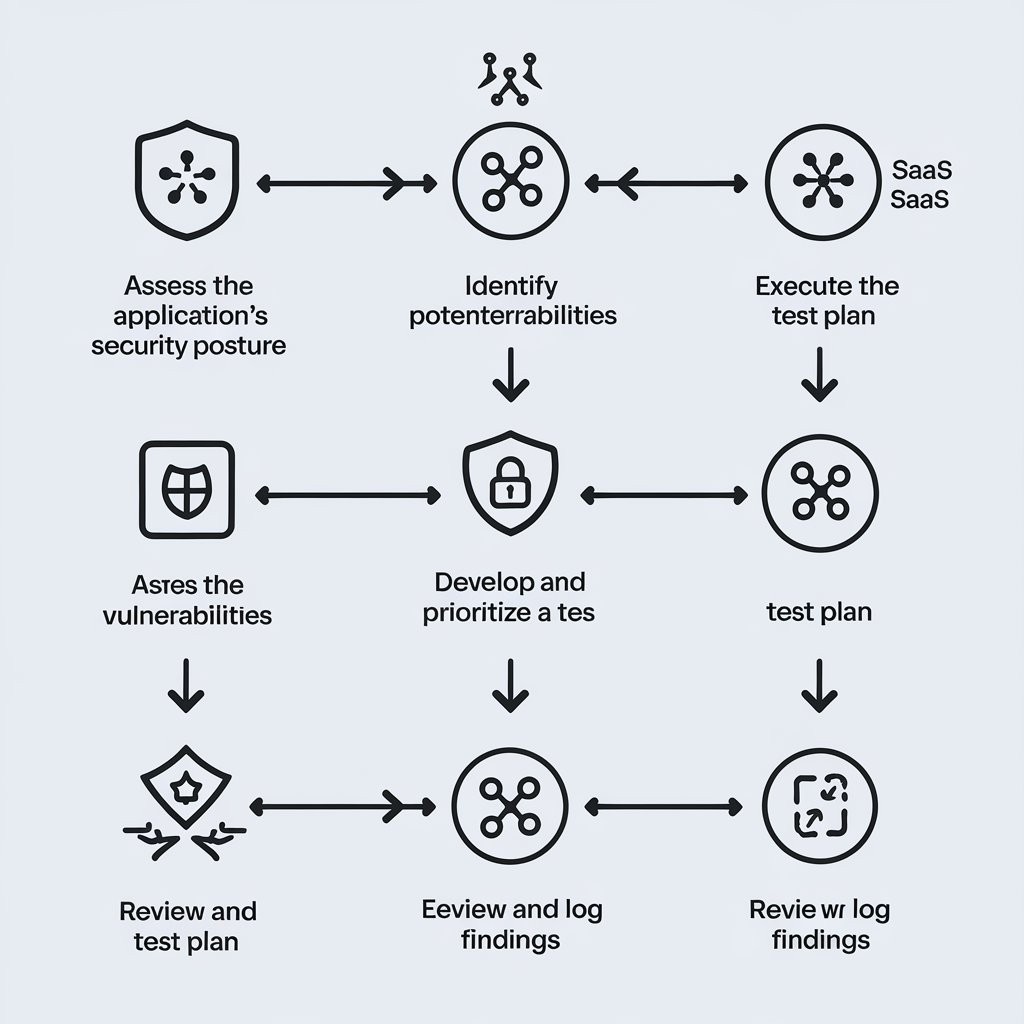

Steps for Fraud Risk Management

1. Implement Advanced Fraud Detection Tools

Use AI-powered fraud detection systems to analyze patterns and flag suspicious activity.

Leverage tools like device fingerprinting, geolocation, and behavioral analytics.

2. Strengthen Payment Security

Adopt PCI DSS-compliant payment gateways.

Enable 3D Secure protocols for added verification.

Tokenize payment data to protect against breaches.

3. Enforce Multi-Factor Authentication (MFA)

Require customers to verify their identity through multiple methods (e.g., SMS codes, biometrics).

Apply MFA for both customer accounts and internal systems.

4. Monitor Transactions in Real-Time

Use real-time monitoring systems to detect anomalies, such as unusual purchasing patterns or high-value orders.

Flag transactions from high-risk regions or blacklisted IP addresses.

5. Educate Customers and Employees

Teach customers to recognize phishing attempts and secure their accounts with strong passwords.

Train employees to spot fraudulent activities and respond appropriately.

6. Regularly Audit and Update Security Measures

Conduct regular security audits to identify vulnerabilities in your e-commerce platform.

Keep systems, software, and plugins updated to protect against known exploits.

7. Employ Chargeback Management Strategies

Maintain detailed transaction records to dispute false chargeback claims effectively.

Use chargeback management solutions to streamline the process.

8. Create a Robust Fraud Policy

Define clear policies for handling suspected fraud.

Establish procedures for investigating and responding to fraudulent transactions.

Best Practices for Fraud Prevention

Identity Verification

Verify customer identities using KYC (Know Your Customer) procedures.

Request additional documentation for high-value or suspicious orders.

Limit High-Risk Transactions

Set purchase limits for new or unverified accounts.

Delay fulfillment of flagged transactions until verified.

Protect Data with Encryption

Encrypt sensitive customer data both in transit and at rest.

Secure your website with HTTPS to protect data exchanges.

Establish a Fraud Response Team

Designate a team to investigate and mitigate fraud incidents.

Use post-incident reviews to improve processes.

Fraud Risk Management Tools

Fraud Detection Platforms: Riskified, Sift, or Signifyd.

Payment Gateways with Built-In Security: Stripe, PayPal, or Adyen.

Behavioral Analytics Tools: BioCatch, ThreatMetrix.

Chargeback Solutions: Chargebacks911, Verifi.

Benefits of Effective Fraud Management

Customer Trust

Protecting customer data fosters loyalty and positive reviews.

Reduced Financial Losses

Proactive measures minimize losses from fraudulent transactions and chargebacks.

Regulatory Compliance

Compliance with data protection laws (e.g., GDPR, CCPA) reduces legal risks.

Business Reputation

Preventing fraud safeguards your brand's reputation in a competitive market.

Conclusion

Fraud risk management is essential for any e-commerce business. By implementing advanced detection tools, strengthening payment security, and educating customers and employees, you can effectively minimize fraud risks. Building a secure and trustworthy platform not only protects your business from financial losses but also fosters long-term customer loyalty in an increasingly digital world. audit3aa

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.

You can copy our materials only after making sure that your services are safe.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.